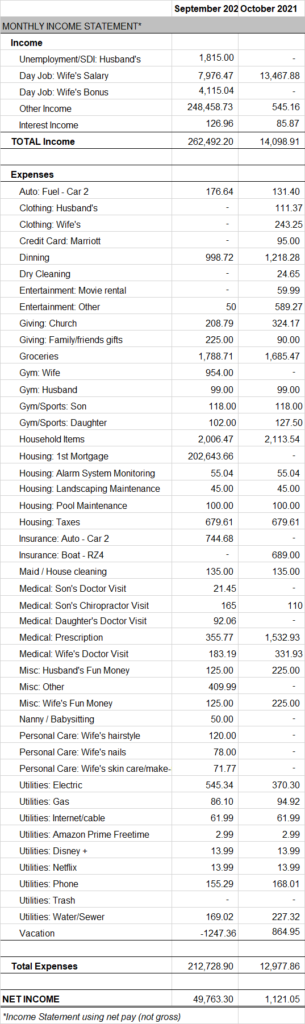

Overall

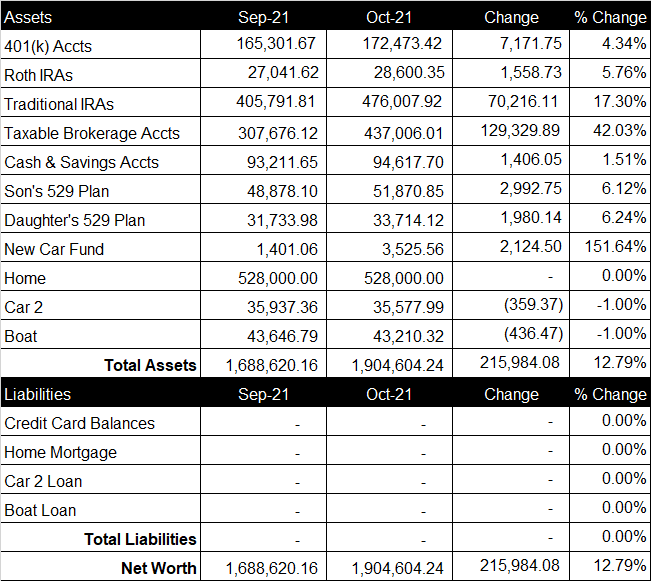

September was a down month for our net worth. Our net worth decreased $83,891.71 from last month to a total of $1,688,620.16 (see spreadsheet screenshot). Even so, we achieved a huge goal of ours by paying off our mortgage. We are completely debt free! We thank God for this blessing.

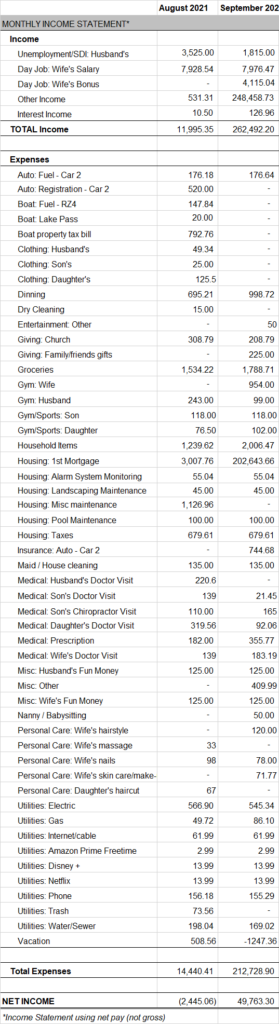

Retirement Accounts

Our retirement accounts are comprised of our 401(k)s, our Roth IRAs and our Traditional IRAs. We contribute 7% to my wife’s 401(k). My wife’s company matches up to 6% of her 401(K) contribution and chips in an additional 3% on top of the match at the end of the year (vests over 5 years). This month, we contributed $1,326.30 to her 401(k). Since I am unemployed, I did not contribute anything to my retirement accounts. The total balance of our retirement accounts decreased $35,029.77 from last month to a total of $598,135.10.

Brokerage Account

Currently, our brokerage account consists of stocks and cryptocurrency (I prefer to track crypto in the “Brokerage Accounts” field rather than “Cash & Savings Accounts”). We sold a portion of our cryptocurrencies to pay off our home mortgage. The total current value of our brokerage accounts is $307,676.12, down $288,309.42 from last month.

Cash & Savings Account

Cash and savings accounts consists of a small sum of cash at home and our online savings accounts balance. It does not include our checking account balance that we use to pay our bills each month. Our savings increased $39,198.07 this month to a total of $93,211.65. We sold some cryptocurrency to pay for a large (~$50K) tax bill in April 2022 that we will have to pay from selling other crypto to pay off our mortgage.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $550 to our son’s 529 Plan and it decreased $1,163.97 from last month to a total balance of $48,878.10. We contributed $500 to our daughter’s 529 Plan and it decreased $613.21 from last month to a total balance of $31,733.98. Total 2021 contributions thus far are $3,850 for our son and $3,890 for our daughter.

Home

For our home value, we use the $528K purchase price that we paid in July 2016. Current comps in the area are ~$840K. We are thrilled to have paid off our home mortgage this month! We had a great rate, 2.375%, but it simply helps us sleep better knowing our housing is covered whatever the future may bring. We paid an extra $201,235.90 to principal to bring our balance to $0. Total 2021 extra payments to principal are $205,035.90.

Vehicles

My wife drives a company vehicle and has a company gas card. I drive a 2017 SUV (~85K miles) that we own. In addition, we own a 2013 ski boat.

New Vehicle Fund

We decided to start a new car fund to cover future vehicle expenses for our kids and eventually ourselves. We contributed $1,530 to the new car fund this month and invested it in cryptocurrencies. We track these crypto investments separately for our others (see brokerage account above).

Credit Card Balance

All of our credit card debt is paid in full each month.