Overall

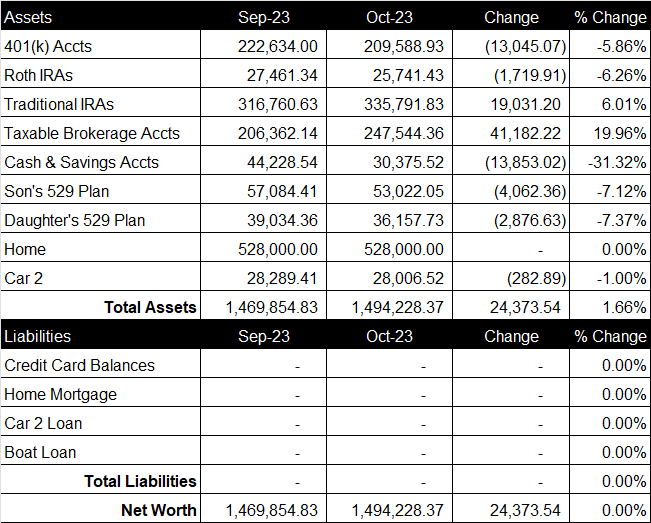

In October, our net worth increased $24,373.54 from last month to a total of $1,494,228.37 (see spreadsheet screenshot).

Retirement Accounts

Our retirement accounts are comprised of our 401(k)s, our Roth IRAs and our Traditional IRAs. We contributed 7% to my wife’s 401(k) and her company matched 4% and chips in an additional 6% at the end of the year. This month, she contributed $1,150.52 to her 401(k). Since I do not work, I did not contribute anything to a retirement account. The total balance of our retirement accounts increased $4,266.22from last month to a total of $571,122.19.

Brokerage Account

Currently, our brokerage accounts consist of stocks and cryptocurrency (I prefer to track crypto in the “Brokerage Accounts” field rather than “Cash & Savings Accounts”). The total current value of our brokerage accounts is $247,544.36, up $41,182.22 from last month.

Cash & Savings Account

Cash and savings accounts consist of a small sum of cash at home, our online savings accounts balance. It does not include our checking account balance that we use to pay our bills each month. Our savings decreased $13,853.02 this month to a total of $30,375.52.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $50 to our son’s 529 Plan and it decreased $4,062.36 from last month to a total balance of $53,022.05. We contributed $0 to our daughter’s 529 Plan and it decreased $2,876.63 from last month to a total balance of $36,157.73. Our total 2023 contributions so far are $3,150 for our son and $3,000 for our daughter.

Home

For our home value, we use the $528K purchase price that we paid in July 2016. Current comps in the area are ~$890K. We paid off our home in September 2021.

Vehicles

My wife drives a company vehicle and has a company gas card. I drive a 2017 SUV (~95K miles) that we own and it is paid off.

Credit Card Balance

All of our credit card debt is paid in full each month.