Overall

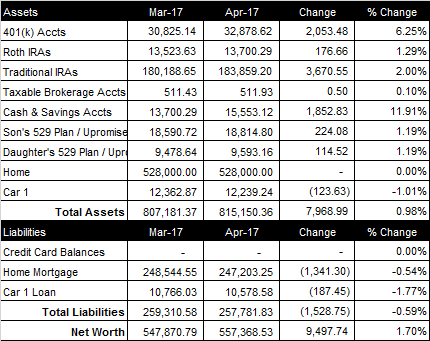

April was a very good month. Our net worth increased $9,497.74 from last month to a total of $557,368.53 (see spreadsheet screenshot). We passed our $550K net worth milestones this month and nearly made it to $560K.

Retirement Accounts

Our retirement accounts are comprised of our 401(k)s, our Roth IRAs and our Traditional IRAs. We contribute 5% to my wife’s 401(k). My wife’s company matches up to 5% of her 401(K) contribution and chips in an additional 5% on top of the match (both 100% vested when deposited). I just started a new job and am not yet eligible for my company’s 401(k) plan. My wife contributed $507.50 to her 401(k) and her company deposited another $1,015.00 into her 401(k) for her 5% match and 5% extra “chip in”. The total balance of our retirement accounts increased $5,900.69 from last month to a total of $230,438.11.

Brokerage Account

Currently, our brokerage account consists of $500 cash and one stock (my wife’s old company) valued at $11.93 (on a $2,000.00 in initial investment). We are moving a little cash into our brokerage account as we are able to with the intent to make a purchase when the market dips again.

Cash & Savings Accounts

Cash and savings accounts consists of a small sum of cash at home and our online savings account balance. It does not include our checking account balance that we use to pay our bills each month. This month our cash and savings accounts increased $1,852.83, bringing the total to $15,553.12.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $0 to our son’s 529 Plan and it increased $224.08 from last month to a total balance of $18,814.82. We also contributed $0 to our daughter’s 529 Plan and it increased $114.52 from last month to a total balance of $9,593.16.

Home

We use the $528K purchase price that we paid in July 2016 for our home value. Current comps in the area are ~$530K. The current balance of our 15-year, 2.85% mortgage loan is $247,203.25. We paid $150 extra towards principal this month.

Cars

My wife has a company vehicle (and gas card) and I have a 2012 sedan with 70K miles. My company gives me a $450/month vehicle allowance and provides me with a gas card. The loan balance on my car is $10,578.58 at 1.99%.

Credit Card Balance

We do not currently have a credit card balance that is not paid in full each month.