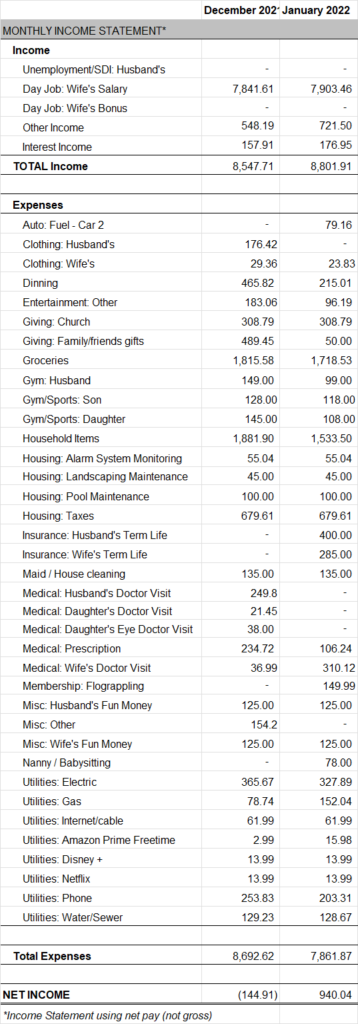

In January, we had a pretty standard income month and an awesomely low expense month.

Our total income in January was $8,801.91. In addition to my wife’s regular paychecks, she received $171.11 in company reimbursements for internet. We received $270.39 in insurance reimbursements and earned $176.95 in interest income from our savings accounts and stablecoins.

This month, our expenses totaled $7,861.87. That is our lowest expense month since mid 2013! Large, expenses included $1,533.50 for household items, $685 for term life insurance and $416.36 for medical costs/prescriptions.

Next month my wife should receive a quarterly bonus of 11,160 (gross).