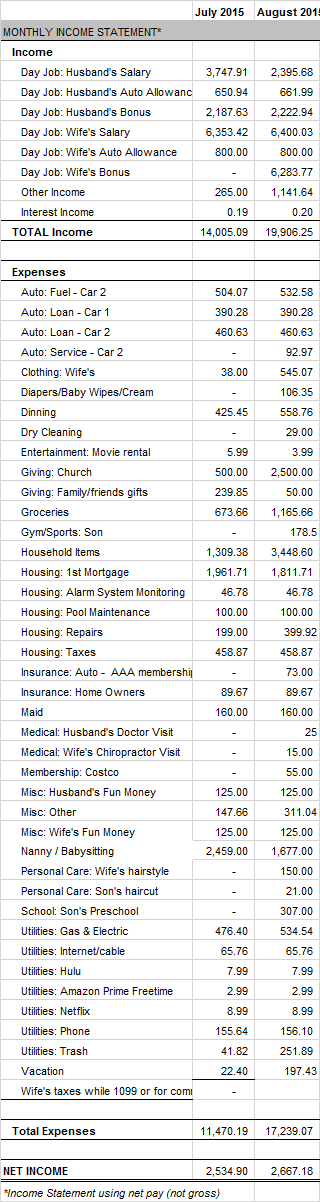

August was a huge income month and huge expense month (see spreadsheet screenshot).

Our total income in August was $19,906.25. In addition to our paychecks, my wife received a $12,500 ($6,283.77 net) quarterly bonus and I received a $4,700 ($2,222.94 net) monthly bonus. My wife received an $800 auto allowance and a $834.64 in misc company reimbursements. I received $661.99 in auto allowance and mileage reimbursement. We also received $307 in preschool reimbursement, and earned $0.19 in interest income from our online savings account.

This month, we spent a total of $17,239.07. Some of our larger, non-typical expenses included $1,811.71 in groceries, $3,448.60 in household items, and $558.76 in dinning.

Next month, my wife and I have resolved to get our expenses down…way down.