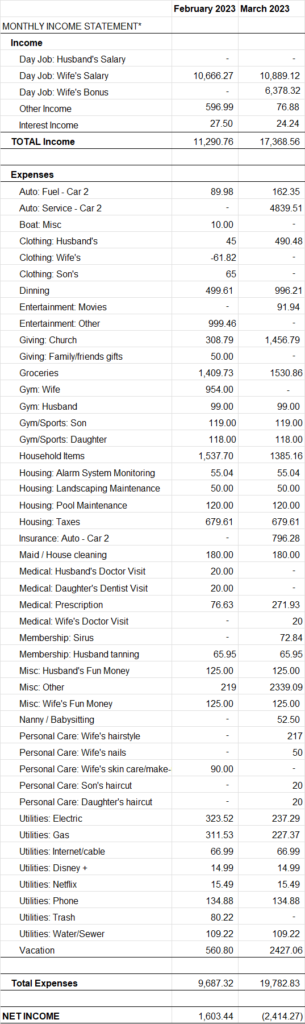

In March, we had an excellent income month and a high expense month.

My wife earned a 3.81% raise, bringing her salary to $197,232, she also received $26,600 in LTI. So proud of her; the raise started on her 3/15/23 paycheck. Our total income in March was $17,368.56. In addition to my wife’s regular paychecks, she received a $11,475 gross ($6,378.32 net) quarterly bonus and $76.88 in company reimbursements for internet. We also earned $24.24 in interest income from our savings accounts.

This month, our expenses totaled $19,782.83; well above our income this month. Large expenses included $4,839.51 for auto service, $2,427.06 for vacation expenses, and $796.28 for car insurance.

In April, we meet with our Tax Accountant to do our 2022 taxes. We will likely owe taxes but we are not sure how much yet. Hopefully it doesn’t wipe out our small amount of savings and put us into debt.