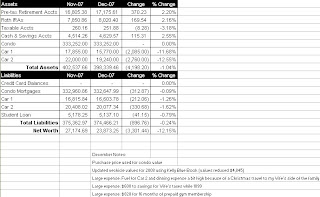

December was the first decrease to our net worth since we began tracking it in February. Our net worth decreased $3,301.44 from last month to $23,873.25 (click on spreadsheet below).

What worked this month?

While December was a roller coaster month in the stock market, thankfully, our investments ended on an up note.

What did not work this month?

December was a bad net worth month because of my poor accounting methods earlier in the year. As I mentioned in a previously post, I have not been depreciating our vehicle values each month, thus, I have been over stating our net worth. Before closing out 2007, I wanted to adjust the vehicle values to give us a more accurate net worth. To reflect the depreciation, you will notice a change of ($2,085) in the asset column for Car 1 and a change of ($2,760) in the asset column for Car 2. It’s no fun taking a $4,845 depreciation hit in one month. So, beginning in January, we will depreciate our vehicles monthly at 1%.

What’s coming next month?

The end of 2007 was rough on our net worth, but thank God we were still able to finish the year 8.51% above our net worth goal of $22,000. I will be posting a review of 2007 within the next couple of weeks.

January should be a strong month and an awesome start to 2008. I receive an extra paycheck (3 total), I plan to cash out a few vacation days, and I should receive my annual pay raise. Most of this extra money will go towards our plan to pay down our 2nd mortgage, but we will also begin contributing to our Roth IRA’s for 2008.