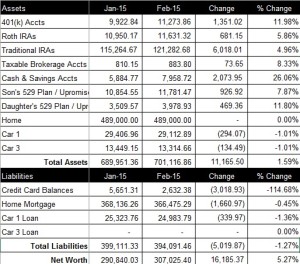

Overall

February was an awesome month for our net worth. It increased $16,185.37, to a total of $307,025.40 (see spreadsheet screenshot). Definitely a nice turn-around from last month. The two main contributors were my wife’s quarterly bonus of $16,745.00 gross ($9,088.68 net) and her large promotion ($97K/year to $130K/year). She’s a keeper:)

Retirement Accounts

Our retirement accounts are comprised of my wife’s 401(k), our Roth IRAs and our Traditional IRAs. My wife’s company matches up to 3% of her 401(K) contribution and deposits the sum once a year on January 1st (it is 100% vested when deposited). This month, we contributed $827.35 to my wife’s 401(k) and saw the total balance of our retirement accounts increase $8,050.18 over last month to $144,187.86.

Brokerage Account

Currently, our brokerage account consists of one stock (my wife’s company) that moved up in February. Our balance is $883.80 on a $2,000.00 in initial investment.

Cash & Savings Accounts

Cash and savings accounts consists of a small sum of cash at home and our online savings account balance. It does not include our checking account balance that we use to pay our bills each month. This month, our cash and savings accounts increased $2,073.95, bringing the total to $7,958.72.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $250 to our son’s 529 Plan and it increased $926.92 over last month to a total balance of $11,781.47. We also contributed $250 to our daughter’s 529 Plan and it increased $469.36 over last month to a total balance of $3,978.93.

Home

We use the $489K purchase price that we paid in January 2012 for our home value. Current comps in the area are ~$650K. The current balance on our mortgage loan is $366,475.29. We have been paying ~$150 in escrow shortage payments for the past year, but our shortage payments are finally complete. We decided to continue paying the extra $150 each month towards principal. Since my wife received an awesome quarterly bonus in February, we added an extra $1,000 on top of the $150. So, we paid $1,150 extra to mortgage principal this month. Sweet!

Cars

“Car 1” is a 2011 SUV with ~55K miles and “Car 3” is a 2004 SUV with ~100K miles. We no longer own a “Car 2”. When calculating our net worth, we depreciate the vehicles 1% per month. Car 1 has a current loan balance of $24,983.79 and Car 3 is paid off.

Credit Card Balance

Great news!! We paid off a $5,651.31 balance on a 0% credit card from a new HVAC that we installed in September 2014. However, we also added another $2,632.38 in credit card debit for office furniture and. It is 0% for two years.