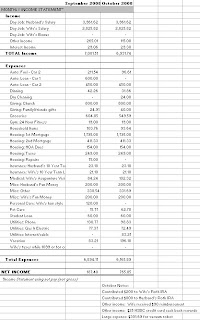

While our net worth in October dropped considerably, our expenses for the month were pretty low (click on spreadsheet below). We spent a total of $ 6,165.89, which is good, especially considering we splurged on a $301.69 vacuum robot and a $196.18 hotel room for my wife while she was in Vegas.

Our incomes this month were pretty standard. In addition to our paychecks, my wife received a $90.00 reimbursement from her company and we earned a $25 cash reward from our HSBC credit card. The interest income of our E*TRADE savings account was $29.30.

Next month, our incomes will be standard but we have some large expesnses: a $1,157 annual auto insurance bill, $439 condo insurance bill, and a $1,169.14 property tax bill. We plan to cash in 5 of my vacation days to cover most of the two annual insurance bills and pull money out of savings to pay the property tax bill. Some of our other expenses should be lighter next month because I will be out of town ½ of the month.

E-Trade?

These guys scare me. I know the interest payout is typically higher; but a lot of it is backed by risky mortgages.

I prefer Scottrade – a private company that does not have to pander to the Street every quarter.

Thanks for the input. E*Trade is FDIC insured so we should be covered if the worst happens.

-1MansMoney

I’m just curious why you still list your house as an asset valued at $333,000 when it is only worth $220,000 (according to the assessor)?

If it’s for psychological reasons, I totally understand 🙂

Anonymous,

For simplicity, I decided to use the purchase price of our condo when we began tracking our net worth. When it went up, I did not increase it’s value on our balance sheet. Now that it has gone down (much more than it ever went up), we have not adjusted it either. Maybe not the most technically correct way of handling our net worth, but it works for us.

-1MansMoney

The Anonymous post above was me.

-1MansMoney