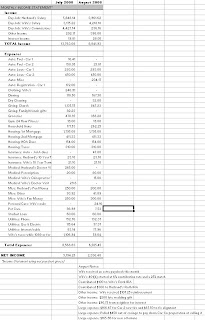

August was our 2nd lowest month of expenses in this year (click on spreadsheet below). My wife was out of town 2-1/2 weeks for business and I was out of town 1 week for business; all of this business travel helped save us some money. While my wife was out of town, I was able to use her company car and gas card, saving us $125-$150 in gas.

We had another strong income month, which is especially nice when combined with a low expense month. My wife earned an “extra” third check this month as well as a $236.16 commission from her old company. We also received a $200 wedding gift that was totally unexpected, but appreciated, since we have been married a couple of years. With our savings account balance rising, we’re starting to see an increase in interest income; this month we earned $28.05 in interest income.

Next month my wife may receive her 1st quarterly bonus, although if she receives anything, it will be a much smaller bonus than what she can expect down the road. We should also earn cash rewards from our Citi credit card and HSBC credit card. The only major expense planned is a few hundred dollars for a new kitchen table and chairs.