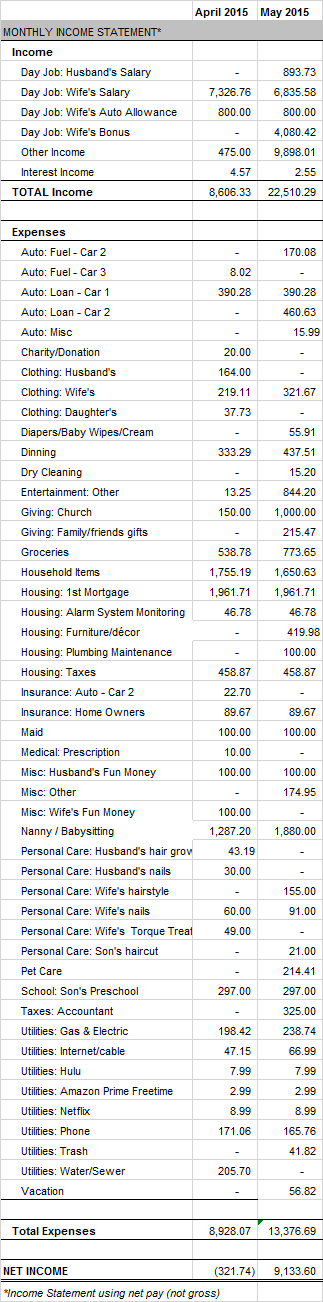

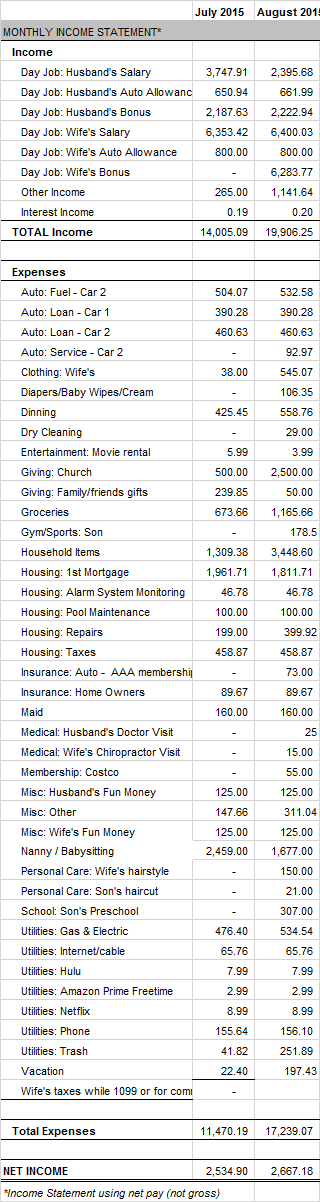

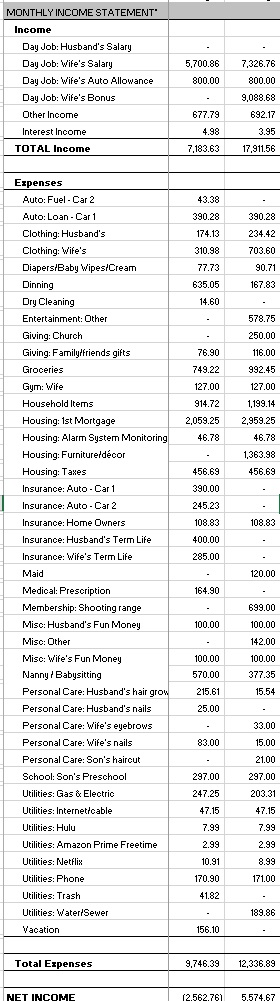

May was an AMAZING income month and a reasonable expense month when compared to our income (see spreadsheet screenshot).

Our total income in May was a whopping $22,510.29, making it our 3rd largest income month since I began tracking in 2007. The big game changers were my Wife’s quarterly bonus of $8,200 gross ($4,080.42 net) and our tax refund of $9,118. In addition to our paychecks (only one week from my new job), my wife received an $800 auto allowance and a $315.01 company reimbursement for internet service and meals. We also received $250 in preschool reimbursement, $215 in gifts for our daughter (deposited into 529 Plan), and earned $2.55 in interest income from our online savings account.

In May, we spent a total of $13,376.69. A ton of money, but a lot less than we made, thankfully. A couple of items like my car payment and fuel for Car 2 will be partially offset by reimbursements from my company next month. We had a big birthday party for our 1-year old daughter, which resulted in a $844 entertainment expense. Nanny/babysitting costs were also higher his month as we increased the hours due to me going back to work.

Next month will be my first full month at my new job, and thus, my first full month of paychecks. We were looking forward to a nice bump to our income, but we were hit by AMT last year, so we will likely increase our 401(k) contributions, reducing our net income. Craziness!