We are currently in escrow on a beautiful 5 bed/3 bath home that should fit our needs for many, many years to come. To keep our monthly mortgage payment low and to avoid PMI, we have elected to raid our retirement accounts for some of the down payment. I know, I know, hear me out..

The 2 bedroom condo that we are renting is $1,550/month and, with our growing family, it is a tight squeeze. After finding our dream home, we quickly realized that the ~$47,000 in our savings was not enough for a 20% down payment. The home was $489,000, so 20% down is $97,800, meaning that we needed to come up with another $51,000.

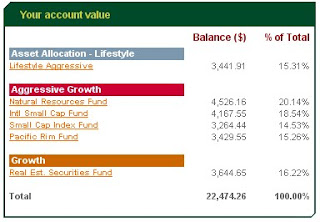

We poached $51,000 from our almost $100,000 in retirement savings. $30,000 came from Roth IRA contributions and $21,000 was borrowed from my 401(k). You can withdraw Roth IRA contributions at any time without penalty or taxes. The 401(k) loan has a 5 year payment schedule at $179.44/check. If I were to leave my company for any reason before the loan is paid back, the balance would be due, or I would have to pay a 10% penalty and income tax on the money.

If the deal goes through, our interest rate will be 3.75%, resulting in a monthly mortgage payment of $1,811 on a mortgage of $391,200. Add $600/month for tax and insurance and we are up to $2,411/month. This is a very comfortable number for us, especially when you consider the tax benefits of owning a home.

Our gross annual income is $150,460, not including my wife’s quarterly bonuses. Using the rule of thumb to spend no more than 35% of our gross income on housing, we can “afford” $4,388/month. Frankly, we had no intentions of spending anywhere close to that. We simply want a nice home with payments that we can still afford if one of us lost our job.