We’ve just completed our first loan on www.prosper.com. If you’re not familiar with this website, it is known as the e-bay of loans.

Basically, you deposit money in your Prosper account (similar to PayPal), browse the Prosper website for a borrower you want to lend to, and bid on the loan. If you win, the money is pulled out of your account and loaned to the borrower (3-year loan). Each month, Prosper then pulls monthly payments (with interest) out of the borrower’s account and transfers it to your account. Pretty simple.

You can bid as little as $50 each time – Prosper complies all of the winning bids to fund the loan. For example, a $2,000 loan could be made up of forty $50 winning bids from 40 different lenders. However, if a loan request is not 100% funded by the time the bidding clock expires, it does not get funded. By bidding small amounts over many different loans, you reduce your risk. I was surprised to find that there are lenders with hunderds of thousands of dollars invested in Prosper loans. Based on Eric’s Credit Community, a site devoted to statistics and information about Prosper.com, it looks like a lender by the name of Pensioner is leading the way.

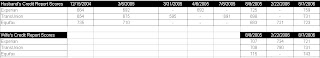

There certainly is an element of risk when you loan money to a perfect stranger in an unsecured loan. Prosper supplies a good deal of information to help you make an informed decision. You have access to the borrower’s credit information (delinquencies, revolving credit balance, etc.), estimated default rates for the various credit ratings, estimated interest rates for various credit ratings, etc. Borrowers provide a reason for why they need the loan and some supply a photo and monthly budget. Borrowers can also join groups to help give them credibility. If they default on the loan, not only are they sent to collections (all handled by Prosper and a third party collections agency) but the group rating is brought down as well.

What’s in it for Prosper? They make 0.5%-1% from the lender for servicing the loan and a 1% or 2% loan closing fee from the borrower.

Here’s the bid we won: https://www.prosper.com/public/lend/listing.aspx?listingID=109590

We like the borrower’s A credit grade, 29% debt to income ratio, and the story he provided for needing the money. And of course, the 13% interest rate doesn’t hurt.

We’re going to do a couple more test loans; I’ll keep you posted on how it goes.