You may have heard that cyptocurrency prices have been increasing dramatically lately. It has absolutely catapulted our net worth this month and we just passed our net worth milestones of $1,210,000 and $1,220,000. Our net worth is currently $1,223,621. We passed our last net worth milestone of $1,200,000 yesterday lol. We hope to reach out next milestone of $1,230,000 later this month.

NET WORTH MILESTONE: $1,200K

Thanks again to our cyptocurrency price appreciation, we just passed our net worth milestone of $1,200,000. Such a blessing! Our net worth is currently $1,203,932. We passed our last net worth milestone of $1,190,000 a few days ago. We hope to reach out next milestone of $1,210,000 later this month.

NET WORTH MILESTONEs: $1,180k & $1,190K

Thanks to our cyptocurrency price appreciation, we just passed our net worth milestones of $1,180,000 and 1,190,000. Our net worth is currently $1,199,802. We passed our last net worth milestone of $1,170,000 earlier this month. We hope to reach out next milestone of $1,200,000 later this month.

NET WORTH MILESTONE: $1,170,000

We just passed our net worth milestones of $1,170,000. Our net worth is currently $1,177,752. We passed our last net worth milestone of $1,160,000 earlier this month. We hope to reach out next milestone of $1,180,000 later this month.

NET WORTH MILESTONE: $1,160,000

We just passed our net worth milestones of $1,160,000. Our net worth is currently $1,167,770. We passed our last net worth milestone of $1,150,000 earlier this month. We hope to reach out next milestone of $1,170,000 later this month.

NET WORTH MILESTONE: $1,150,000

We just passed our net worth milestones of $1,150,000. Our net worth is currently $1,157,473. We passed our last net worth milestone of $1,140,000 last month. We hope to reach out next milestone of $1,160,000 later this month.

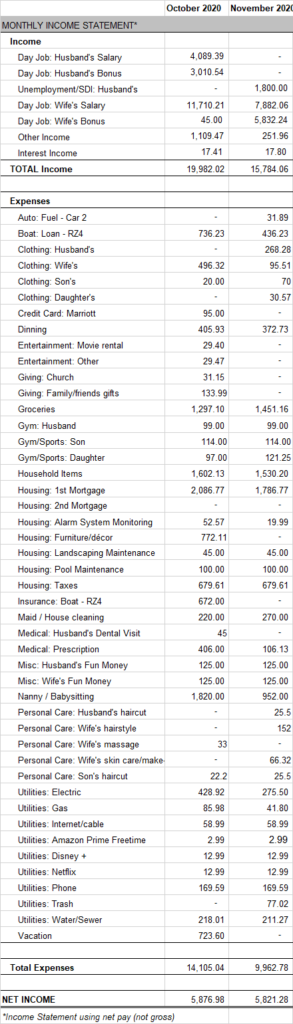

November 2020 Income Statement

In November, we had a slightly lower income month due to me quitting my job at the end of October. Thankfully, we also had a lower expense month.

Our total income in November was $15,784.06. In addition to my wife’s regular paychecks, she received $251.96 in company reimbursements and $10,000 gross ($5,832.24net) quarterly bonus. I received $1,800 in unemployment in November. Plus, we earned $17.80 in interest income from our savings accounts.

This month, our expenses totaled $9,962.78. This was a huge improvement over our typical monthly spending. We had little in the way of large, non-recurring expenses. We spent $464 for clothing and $269 on personal care items (haircuts, etc).

Next month, we need to lower our expenses a bit more because my wife won’t have any additional bonuses until next quarter.

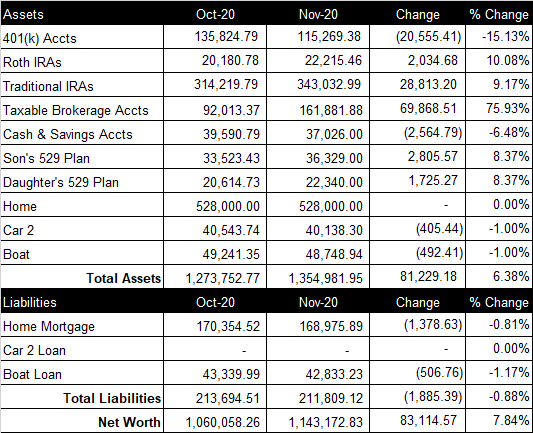

November 2020 Net Worth Update (+$83,114.57)

Overall

November was my first full month jobless after quitting on 10/27/20. That didn’t slow us down though and our net worth increased an amazing $83,114.57 from last month to a total of $1,143,172.83 (see spreadsheet screenshot). This was our 3rd largest one month net worth increase ever (1st was June 2016 and 2nd was July 2020).

Retirement Accounts

Our retirement accounts are comprised of our 401(k)s, our Roth IRAs and our Traditional IRAs. We contribute 7% to my wife’s 401(k). My wife’s company matches up to 6% of her 401(K) contribution and chips in an additional 3% on top of the match at the end of the year (vests over 5 years). This month, we contributed $761.54 to her 401(k). Since I am unemployed, I did not contribute anything to my retirement accounts. In fact, I withdrew $32,888.93 gross ($23,722.46 net) from my 401(k) under C.A.R.E.S. Act and invested the money in cryptocurrencies. The total balance of our retirement accounts increased $10,292.47 from last month to a total of $480,517.83.

Brokerage Account

Currently, our brokerage account consists of stocks and cryptocurrency (I prefer to track crypto in the “Brokerage Accounts” field rather than “Cash & Savings Accounts”). Our cryptocurrencies have been on a tear lately due to contributions and market activity. The $23,722.45 that I pulled from my old 401(k) to by cryptocurrencies this month is already up $4,600, or 19.38%, in one month. The total current value is $161,881.88, up $69,868.51 from last month.

Cash & Savings Account

Cash and savings accounts consists of a small sum of cash at home and our online savings accounts balance. It does not include our checking account balance that we use to pay our bills each month. Our savings decreased $2,564.79 this month to a total of $37,026.00.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $0 to our son’s 529 Plan and it increased $2,805.57 from last month to a total balance of $36,329. We contributed $0 to our daughter’s 529 Plan and it increased $1,725.27 from last month to a total balance of $22,340.

Home

We use the $528K purchase price that we paid in July 2016 for our home value. Current comps in the area are ~$675K. The current balance of our 15-year, 2.875% mortgage loan is $168,975.89. We paid $0 extra towards our home mortgage principal this month.

Vehicles

My wife drives a company vehicle and has a company gas card. I drive a 2017 SUV (~80K miles) that we own. In addition, we have a ski boat with a loan balance of $42,833.23 at 5.24%. We paid $0 extra to our boat loan this month.

Credit Card Balance

All of our credit card debt is paid in full each month.

NET WORTH MILESTONE: $1,130,000 and $1,140,000

What a month! We just passed our net worth milestones of $1,130,000 and $1,140,000. That is the seventh net worth milestone we have passed this month! Our cyptocurrency investments are paying off big time. Our net worth is currently $1,145,384. We passed our last net worth milestone of $1,120,000 a couple of days ago. We hope to reach out next milestone of $1,150,000 next month.

NET WORTH MILESTONE: $1,120,000

We passed our net worth milestones of $1,120,000 this month. Our net worth is currently $1,124,072. We passed our last net worth milestone of $1,110,000 a few days ago. We hope to reach out next milestone of $1,130,000 next month.