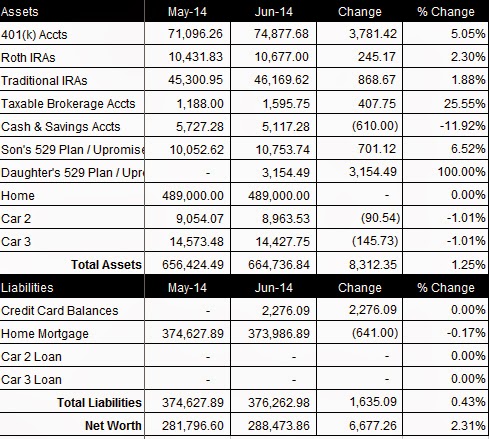

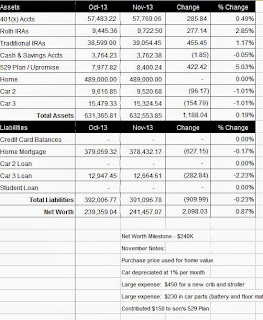

In July, our net worth decreased $3,801.350, to a total of $284,672.36.

What Worked

Our daughter’s new 529 Plan had a $5.61 increase over last month

What Didn’t Work

We passed a net worth milestone of $290,000 in June, but dropped back well below $290K and have not yet recovered. We also added another hospital bill to the 0% credit card. We contribution at total of $818.88 (low because my wife is currently on disability) to our retirement accounts and saw them decrease $2,216.94.

Next Month

September 19th will be my last month working at my current company. I have decided to take a break (hopefully short) to spend time with my family and then begin looking for a new job. So, we’ll try to get more money tucked away into savings in August to help get us through my period of unemployment.