Overall

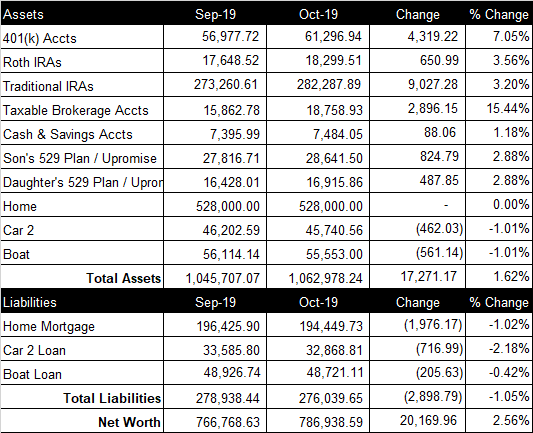

October was another amazing month for our net worth. Our net worth increased $20,169.96 from last month to a total of $786,938.59 (spreadsheet screenshot). Stoked to pass our net worth milestone of $770K and $780!

Retirement Accounts

Our retirement accounts are comprised of our 401(k)s, our Roth IRAs and our Traditional IRAs. We contribute 7% to my wife’s 401(k). My wife’s company matches up to 5% of her 401(K) contribution (100% vested when deposited) and chips in an additional 5% on top of the match in March (vests over 3 years). This month, we contributed $847.84 to her 401(k). We contribute 10% to my 401(k) and my company matches up to 4% and deposits the match in March (100% vested when deposited). This month, we contributed $894.62 to my 401(k). The total balance of our retirement accounts increased $13,997.49 from last month to a total of $361,884.34.

Brokerage Account

Currently, our brokerage account consists of a handful of stocks and cryptocurrency (I prefer to track crypto in the “Brokerage Accounts” field rather than “Cash & Savings Accounts”). The total current value is $18,758.93, up $2,896.15 from last month.

Cash & Savings Account

Cash and savings accounts consists of a small sum of cash at home and our online savings accounts balance. It does not include our checking account balance that we use to pay our bills each month. Our savings increased $88.06 this month, to a total of $7,484.05.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $0 to our son’s 529 Plan and it increased $824.79 from last month to a total balance of $28,641.50. We contributed $0 to our daughter’s 529 Plan and it increased $487.85 from last month to a total balance of $16,915.86.

Home

We use the $528K purchase price that we paid in July 2016 for our home value. Current comps in the area are ~$530K. The current balance of our 15-year, 2.85% mortgage loan is $194,449.73. We paid $660 extra towards our home mortgage principal this month.

Vehicles

My company provides me a vehicle and gas card. My wife has a 2017 SUV with 70,000 miles. Her company gives her $300/month auto allowance and $0.53/mile reimbursement. The loan balance on my wife’s car is $32,868.81 at 2.79%. We paid $100 extra towards our auto loan principal this month. We also have a ski boat with a loan balance of $48,721.11 at 5.24%.

Credit Card Balance

All of our credit card debt is paid in full each month.

I appreciate your blog and a few others for actually laying out numbers! Two questions for you:

1) What’s your logic behind paying extra on the home and car loan but not the higher interest boat loan?

2) You don’t carry a lot of cash relative to your expenses, and your brokerage account seems to be in volatile crypto. Do you have a plan for how to navigate tough times if they come up?

Thanks for the comment Robert!

We pay accelerated payments on our home because we love the idea of knowing that in 8 years, no matter what happens with the stock market, our jobs, etc, we will have the house paid off.

We were paying a little extra on the boat but switched them to my wife’s car loan. She really wants her car paid off. So, even though the math means it’s a worse strategy, we decided to do what makes her feel good. Like they say, marriage is all about compromise

Robert, I failed to answer your 2nd question. Saving cash is an area that we have struggled with. For many years, we’ve made a goal to get $20K into saving and simply have not made it happen. Every time we get close, we end up blowing a large sum on a house project, vacation, etc. We know that is an area we are way behind in and hope to fix it in 2020.