Overall

First of all, great news, I am starting a new sales job in May! I quit my job of 13 years in September 2014 and have been looking for an opportunity that provides better work/life balance. I will be working out of my home office and visiting accounts in the field locally. No more business trips every month:) The base salary is $52K and the bonuses if I hit my goals total $28K/year (not capped). They will pay a fixed amount to me each month for my vehicle and a variable amount based on the miles that I drive. Another positive is that this will be my first company that I’ve worked for with a 401(k) match, albeit only up to a max of $1,000/year.

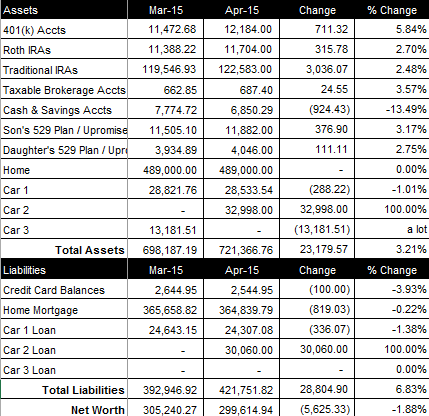

April was a negative month for our net worth, primarily due to trading in “Car 3” for a newer vehicle (“Car 2”). Our net worth decreased $5,625.33 this month, to a total of $299,614.94 (see spreadsheet screenshot).

Retirement Accounts

Our retirement accounts are comprised of my wife’s 401(k), our Roth IRAs and our Traditional IRAs. My wife’s company matches up to 3% of her 401(K) contribution and deposits the sum once a year on January 1st (it is 100% vested when deposited). We contributed $325 to my wife’s 401(k) this month and saw the total balance of our retirement accounts decreased $4,063.17 over last month to $146,471.00.

Brokerage Account

Currently, our brokerage account consists of one stock (my wife’s company) that went up a bit this month. Our balance is $687.40 on a $2,000.00 in initial investment.

Cash & Savings Accounts

Cash and savings accounts consists of a small sum of cash at home and our online savings account balance. It does not include our checking account balance that we use to pay our bills each month. This month, our cash and savings accounts decreased $924.43, bringing the total to $6,850.29.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $50 to our son’s 529 Plan and it increased $376.90 over last month to a total balance of $11,882.00. We contributed $0 to our daughter’s 529 Plan and it increased $111.11 over last month to a total balance of $4,046.00.

Home

We use the $489K purchase price that we paid in January 2012 for our home value. Current comps in the area are ~$650K. The current balance on our mortgage loan is $364,839.79. We paid an extra $150 towards principal this month.

Cars

“Car 1” is a 2011 SUV with ~60K miles and “Car 2” is a 2012 SUV with ~55K miles. “Car 2” was purchased this month because the company I am starting with in May requires a newer vehicle to receive the monthly reimbursement. When we purchased “Car 2” they gave us $7,000 off for trading in “Car 3”. When calculating our net worth, we depreciate the vehicles 1% per month. “Car 1” has a current loan balance of $24,307.08 and Car 2 has a current loan balance of $30,060.00. My wife receives $800/month as a car reimbursement and her gas is paid for by her company. When I start my new job in May, I should receive ~$350/month as a fixed car reimbursement and a certain amount per mile as a variable reimbursement (to cover gas, wear and tear, etc.)

Credit Card Balance

Our credit card interest is 0% for two years. This month, our credit card debit went down $100.00 to a total of $2,544.95.

Congratulations on your new job! It’s awesome how you track everything from month to month, right down to the percentage change. What a great way to see it all on paper!

Thanks Jayleen! I’m excited to get back out in the workforce and increase our investment contributions. For our net worth tracking, I stole the layout from http://www.2millionblog.com.