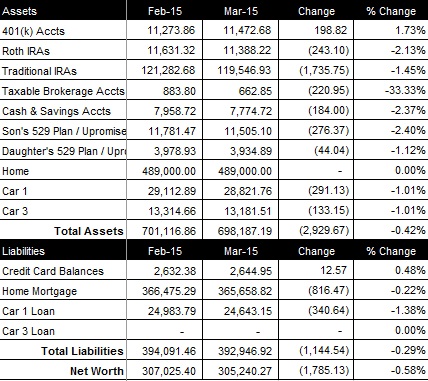

March was a negative month for our net worth. It decreased $1,785.13, to a total of $305,240.27 (see spreadsheet screenshot).

Retirement Accounts

Our retirement accounts are comprised of my wife’s 401(k), our Roth IRAs and our Traditional IRAs. My wife’s company matches up to 3% of her 401(K) contribution and deposits the sum once a year on January 1st (it is 100% vested when deposited). We contributed $325 to my wife’s 401(k) this month and saw the total balance of our retirement accounts decreased $1,780.03 over last month to $142,407.83.

Brokerage Account

Currently, our brokerage account consists of one stock (my wife’s company) that went down in March. Our balance is $662.85 on a $2,000.00 in initial investment.

Cash & Savings Accounts

Cash and savings accounts consists of a small sum of cash at home and our online savings account balance. It does not include our checking account balance that we use to pay our bills each month. This month, our cash and savings accounts decreased $184.00, bringing the total to $7,774.72.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $0 to our son’s 529 Plan and it decreased $276.37 over last month to a total balance of $11,505.10. We contributed $50 to our daughter’s 529 Plan and it decreased $44.04 over last month to a total balance of $3,934.89.

Home

We use the $489K purchase price that we paid in January 2012 for our home value. Current comps in the area are ~$650K. The current balance on our mortgage loan is $365,658.82. We paid an extra $150 towards principal this month.

Cars

“Car 1” is a 2011 SUV with ~55K miles and “Car 3” is a 2004 SUV with ~100K miles. We no longer own a “Car 2”. When calculating our net worth, we depreciate the vehicles 1% per month. Car 1 has a current loan balance of $24,643.15 and Car 3 is paid off.

Credit Card Balance

Our credit card interest is 0% for two years. This month, our credit card debit went up $12.57 to a total of $2,644.95.

You guys seem to be on top of all this financial stuff even with the net worth loss. I would love to have you contribute here: http://www.howdothejonesdoit.com/how-do-they-do-that-its-your-turn/

Nice work. It’s interesting that you hold shares of your wife’s company […]

Thanks Elroy! We generally do not invest in the companies that we work, but we went against our better judgement this time. Hasn’t worked out so well yet:)