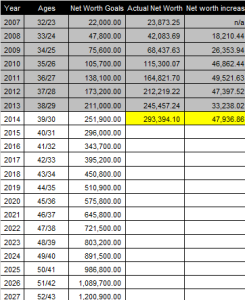

Back in early 2007, I posted annual net worth goals for the next 20 years. Time flies and we’re nearly 8 years into it and one year ahead of schedule (see table below, current year in yellow).

The annual goals were based on a few assumptions/guesses that I made back in 2007: 1) An 8% average return on investments, 2) $12K in contributions to retirement accounts each year, and 3) $12K in debt reduction each year. Back in 2007, we had a household income of $101K, so those seemed like good challenges. Thanks to my wife’s dramatic increase in income, our household income is up to $250K+ this year. As a result, we have been able to contribute more than my original estimates to retirement savings and paying down debt.

My hope is that we can continue to outpace the annual goals, hopefully by years, and get to a point where we can semi retire in 2027. To do so, we will have to continue to increase our retirement contributions each year and focus on paying down our mortgage.

Hey, awesome job! We hope to increase retirement savings but we need to focus on cutting spending in order to do that!

Yep, we’re in the same boat. Our spending has been a little crazy lately considering that I am in between jobs. I wish I had more will power:)

You actually make it seem so easy with your presentation but I find this topic to be really something which I

think I would never understand. It seems too complex

and extremely broad for me. I’m looking forward for your next post,

I’ll try to get the hang of it!

Wow, this piece of writing is fastidious, my younger sister is analyzing these kinds of things, thus I am

going to tell her.