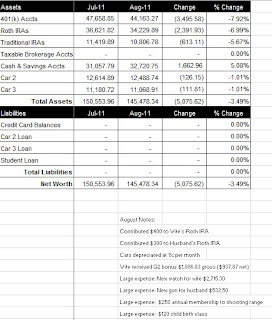

A market correction was bound to happen :). As a result, our net worth decreased $5,075.62 from last month, to a total of $145,478.34 (click on spreadsheet below).

What Worked

With the huge drop in the stock market, everything went on “sale”. William Bernstein, author of The Four Pillars of Investing, has said that young savers should be praying for a bear market so they can accumulate shares cheaply before they retire. So, we contributed $1,513.00 to our retirement accounts, but saw them decrease $6,500.62 to $89,199.94. We were blessed with my wife earning a Q2 2011 bonus of $1,006.83 gross ($937.87 net).

What Didn’t Work

Our retirement accounts were down $15,000+ earlier in the month, but rebounded considerably, cutting out paper loss in half. Our spending was completely out of control this month. I will provide details in my income statement post in a couple of days.

Next Month

September it is going to be a great month because our first baby will be born. We have a couple of large bills in September: $1,845 for cord blood banking and $400 for balance due to doula. We will also be adding the baby to my wife’s insurance increasing the cost from $75/month to $325/month. Depending on the timing of the baby’s birth, my wife and I are also scheduled to be in our friend’s wedding, which will be roughly $200 for tux (my wife already bought a dress). With these bills hitting next month, we do not plan to save anything beyond my 401k contribution in September.

Wow… Did I read that correctly? A $2700 watch?

You should almost list it as an asset next month! 😉

Brainy – Yes, the wheels fell off the cart :). As a “push” present for my wife (our baby is due anytime) we splurged big time and purchased a very nice timepiece for her. I see it as an investment in natural resouces ;).

-1MansMoney