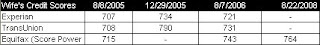

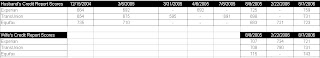

My wife and I order our credit reports and credit scores from time to time to keep tabs on things, and, more importantly, make sure we are not the victims of identity theft.

Below is a table (click on spreadsheet) that I began compiling recently of our credit score track record. BTW, I received numerous copies of my credit reports in 2005 because we were preparing to purchase our condo. As you can see, my score dropped considerably around 3/31/05 because I was disputing a collection on my record. While I had heard that disputes temporarily hurt your score, the extent to which it dropped was startling.

What was I disputing? Well, back in 2003 I informed all of my credit card companies that I had moved and provided my new address. I received a disturbing call a few months later from a collection agency stating that I hadn’t make a payment on my HBSC credit card for months. My finances were in such disarray at the time that the only trigger for me to make a payment was to receive a bill. I contacted HBSC to find out what happened. I was told that when they updated my address in the system they failed to also update the address my bill was sent to. That makes no sense to me, but I also accept that I’m responsible for keeping my payments current, whether I receive a bill or not. I immediately paid off the $360 balance and was assured by the collection agency that my credit wouldn’t be dinged. I didn’t check my credit reports until the end of 2004, and as it turns out, the HBSC credit card showed up as a derogatory account. It took a couple of months of headache and heartache to get the necessary letter from HBSC so that my credit report could be corrected.

Our scores are at a pretty good place now. Out of the maximum score of about 850 (each credit bureau has its own range / methods for calculating your score), we’re not doing too bad. For tips on improving your credit score check out check out Liz Pulliam Weston’s article 9 ways to build a killer credit score.

NOTE: There’s a large gap during which I didn’t track of my wife’s credit report scores.

You can get a free credit report once a year from annualcreditreport.com. Speaking of which, it’s just about time for us to check on our reports. . .