I have subscribed to Surfer Magazine for years and have always enjoyed the content. That being said, I was preparing to send in my check for $37.97 (2 year subscription) when I decided to stop and think about my decision.

Lately, I’ve been doing most of my reading online (cheap, easy, and convenient). The Surfer Magazine website has tons of information, as well as an interesting forum. This realization, along with the fact that I seem to have less and less time for flipping thru a magazine has lead me to a decision to forego my subscription for now.

I realize that $37.97 is nothing in the grand scheme of things, but I am trying to get myself out of the habit of spending money on auto pilot. I want to do a better job analyzing my purchases to ensure that I am getting the most bang for my buck.

What A Difference A Couple Of Years Make

At the time, we were renting an apartment, in a lot of debt (my fault), and had little in the way of assets. Comparing the numbers from 2005 with 2007 reminds me how greatly we have been blessed. Here is a brief breakdown of where we were financially in August 2005 and were we are today:

August 2005

Liquid Assets

$5,157.00 401(k)

$1,547.00 Cash & Savings Accts

$759.00 Taxable accounts

$7,454.00 Total

Credit Card Debt

$10,630.56 (9.99%- 15.49% interest rate)

Net Pay Every 2 Weeks

$1,390.00 (Husband)

$1,180.00 (Wife)

$2,570.00 Total

August 2007

Liquid Assets

$12,805.68 401(k)

$3,326.97 Cash & Savings Accts

$6,278.41 Roth IRA’s

$838.79 Taxable accounts

$23,249.85 Total

Credit Card Debt

$1,249.49 (0% interest rate)

Net Pay Every 2 Weeks

$1,880.70 (Husband)

$1,200.00 plus bonuses and commissions (Wife)

$3,080.70 Total plus Wife’s bonuses and commissions

The Cost Of Not Flossing Enough

Steady Progress II

We just broke $23,000 in liquid assets (pre-tax retirement accounts, Roth IRAs, taxable accounts, cash & savings accounts). As of this morning, we’re at $23,030.04, a nearly $3,000 increase over less than two months ago. Not too shabby with the stock market turbulence.

Additional Contribution to Wife’s Roth IRA

With the market down, my wife suggested that now would be a good time to do another contribution to her Roth IRA, which is invested in the Vanguard 500 Index Fund.

She opened her Roth IRA back on May 8, 2007 by purchasing $3,000 of Vanguard 500 Index Fund at $139.02/share. It is now trading at $132.16/share. With $1,000 left to fully fund her Roth IRA for the year, we decided to invest another $500 this month. We will likely invest the final $500 in her Roth IRA next month to get her to the $4,000 fully funded level.

After her Roth is fully funded, we will have just $1,000 left for my Roth IRA to be fully funded for the year, which will likely be done just before year end.

That will bring us to a total of $8,000 invested for the year in our Roth IRA’s. Next year, the maximums increase and we will be able to invest up to $10,000 in our Roth IRA’s ($5,000 in each) . Good stuff.

Bought A New Mattress

We were able to sell our mattress today and got $100! Thanks to my husband we can save more of my commission check now.

Posted by: The Wife

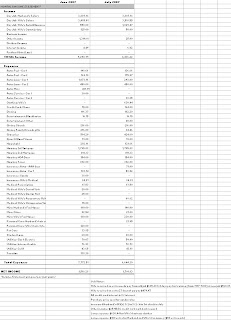

July 2007 Income Statement

July was a strong income month with my wife earning an additional $1,674.68 above her normal pay/auto allowance. We were also able to keep our expenses within reason compared to previous months (click spreadsheet below).

We only went over budget $650, and if you subtract out the $630.44 we spent on business clothing for my wife’s new job, we would have hit our budget mark. It’s encouraging to know our budget is realistic and doable. Although, with a couple of large expenses forecasted for August, it’s doubtful that we will be this close to our budget next month.

July 2007 Net Worth Update (+$2,039.64)

July was our lightest net worth increase month yet. Our net worth increased $2,039.64 over last month, to a new total of $15,062.84 (click spreadsheet below).

Still, we had a better month than I expected, primarily because a $1,000 business expense has not posted yet . Here are the highlights from July:

- In an effort to sock away a bit more money, we increased my 401(k) contribution from 2% to 3%.

- My wife received an additional $1,674.68 in income in July that greatly helped boost our savings account balance.

- Our retirement investments were doing very well most of the month, but plummeted last week, resulting in end of month balances that are lower than June.

- We paid down our liabilities by their standard monthly rate with the exception of our credit card, which we paid a little extra on.

August should be an interesting month. I will receive an extra paycheck ($1883.49 + an additional $76.33 to my 401k) and will also possibly receive my annual company profit sharing (~$550). However, my wife’s 1st paycheck at her new job will only be for one week’s pay. We also have some large bills due in August including $716.53 for a new mattress, $300 for a seat we are sponsoring at our church’s new location, and $1,000 for a business expense that I was already reimbursed for. Our August net worth increase may look very similar to July’s, but as long as we’re headed in the right direction, I’m not complaining.

Wife’s Multiple Paychecks

My wife received a lot of extra income at the end of July as a result of leaving one company and starting with a new company. Here’s the breakdown:

- Her old company gave her a paycheck for 3 weeks (instead of 2), since they needed to cash her out for her final week that would have normally fallen in the next pay period. This added $635.20 after taxes to her normal paycheck.

- Her old company gave her an additional 27 days of fuel reimbursement, which totaled $479.47 after taxes (she would normally be reimbursed in August).

- She was paid $560.01 after taxes for 4 days of training at her new job. She was able to do the training while concurrently working at her old job.

We used this extra income to buy new business clothes for my wife and increase our savings account balance. Her next paycheck on 8/10 (at her new company) will only be for 1 weeks worth of work, so we also keep some of the extra money in our checking account to cover August expenses.

The fun doesn’t stop there, my wife is also expecting a final commission check (~$1,000) from her old company the second week of September.