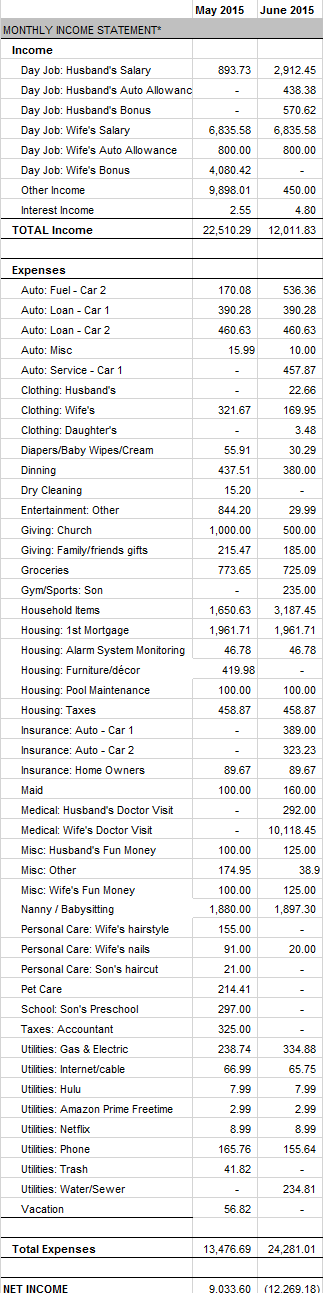

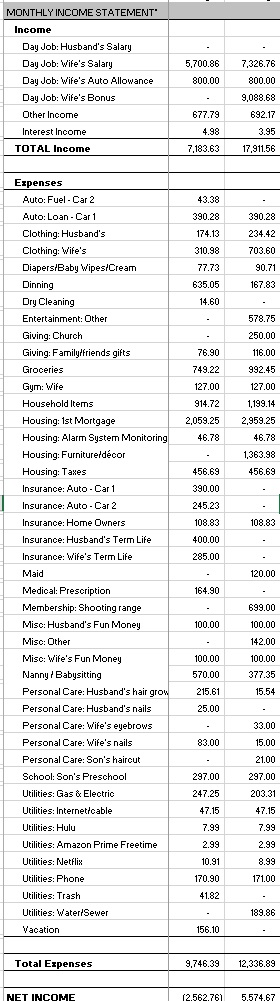

June was a strong income month and a crazy expense month (see spreadsheet screenshot).

Our total income in June was $12,011.83 (my first full month of income at my new job). In addition to our paychecks, my wife received an $800 auto allowance and a $150 company reimbursement for internet service. I received $438.38 in auto allowance and mileage reimbursement. We also received $250 in preschool reimbursement, $165 in gifts for our daughter (deposited into 529 Plan), and earned $4.80 in interest income from our online savings account.

It’s hard to write but in June we spent a total of $24,281.01. Definitely the largest month we’ve had since I’ve began tracking in early 2007. The big ticket item this month was $10,118 for my wife’s elective surgery. I also had $292 in lab fees, $457.87 in auto service, and $3,187.45 in “household items”. Household items is becoming a catch-all for stuff that should probable get its own line item…eventually.

Next month, our income will drop a bit as my 25% contribution to 401(k) kicks in. Interestingly, my HR department called me to make sure that I meant 25% and not $25 dollars per check. I know it’s a large percentage, but it only amounts to $13K/year plus whatever is contributed from my monthly bonuses.