There have been rumblings at my wife’s company that trouble was on the way. Well, yesterday, trouble arrived.

My wife’s company laid off 75% of their employees, agreeing to pay them until September 5. The remaining skeleton crew will likely finish the final business before the company closes their doors.

My wife receives her standard paycheck via direct deposit tonight at midnight. We’re not holding our breath on the final check they promised her on September 5. Unfortunately, it’s hard to get blood out of a turnip. Thankfully, this happened at a time when our savings is higher than it’s been in months ($3,326.97). In addition, my wife is expecting a final commission check from her old job (~$1,000) and a commission check on a job that she referred to her dad’s company (~$700).

It’s disappointing because my wife enjoyed her work, got along well with her co-workers and bosses, and had an opportunity to earn great money. She also quit her old job only a month ago and is forced back into the job search. Other employees that were hired by her company just a month or two ago moved here from out-of-state to start their careers. Now, after spending the money moving out here and signing apartment leases, they are left without a job. What shocked me the most was to hear is that they hired another group of employees just last week. These people probably left decent jobs, just like my wife, only to be unemployed a week later.

There’s no time to cry over spilled milk. My wife has hit the ground running. In less than 24 hours of receiving the news, she has already updated her resume, had one face-to-face interview, had a phone interview, and spoken with a recruiter. Tomorrow, she has a phone interview (set-up by a retired VP of the company that she knows), plans to do some marketing for her father’s company, will investigate her unemployment benefits, and will continue her online job search.

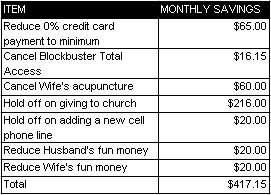

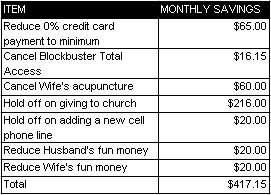

We have put together an action plan to limit our expenses and increase our cash flow while my wife is between jobs:

Thanks to my wife’s extra commission checks, and our plan to reduce expenses, we probably won’t have to dip until savings for at least one month. After which time, our savings should last a couple of months. Worst case scenario, if we blow thru our savings, we can consider placing charges onto our credit cards or pull contributions from our Roth IRAs. I don’t see it getting to that point as I’m confident that we will pull thru this hiccup without any long term damage.