Unfortunately, July looks like it will be a very weak month for our net worth. We went so far over budget in June that we will have to use money that would have been deposited into savings in July to cover our June expenses. We also used a $1,000 reimbursement check from my company to get my Roth funded a bit earlier. If the business charges post to the credit card next month, we’ll have to use most of our savings to pay it back. I’m hoping the charges will hit after our July statement, as I receive 3 paychecks in August and will be in a much better position to pay.

Category Archives: Budget

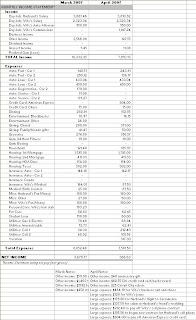

April 2007 Income Statement

We went way over budget again. Darn it!

To our credit, it was not because we spent frivolously. There were numerous one-time, annual, and prepayment expenditures that brought our total expenses for April to $7,581.50 (click on spreadsheet below).

On the positive side, my wife netted an extra $1,147.24 in commissions, we had $127.55 in “other” income (see spreadsheet notes), and our interest income doubled to $11.08.

May is forcasted to be a lighter month for us expense wise. If nothing unforseen pops-up (yeah right), we should spend roughly $1,300 less than we did in April.

Stong Financial Foundation

Live below your means

I believe this is one of the most important steps to a strong financial foundation and, for me, one of the hardest. If you try to keep up with your rich looking friends and associates, you may end up like most of them: lots of nice stuff, but a low net worth. Every dollar that you save is worth more than an extra dollar earned because the extra dollar earned is taxed.

Start an emergency fund

Job loss, health issues, and expenisve repairs are financial blows that can affect us all. Open a high yeild savings account (Emigrant Direct, ING, etc.) and start saving for the unexpected.

Aviod credit card debt

Credit card debt is the path to financial ruin. Been there, done that. Believe me when I tell you that digging the hole is very, very easy and climbing out is often a long, hard fought battle. The only thing we use credit cards for now are monthly bills because we get cash back from our Citi credit card. Don’t do this if can’t pay off the balance in full each month.

Track spending / create a budget

It’s easy to overspend if you don’t know what you’re spending. Track spending for a few months and use this information to create a budget. The budget will help keep you on track and hopefully help you find areas where you can reduce spending.

Learn all you can about investing

Most financial planners are more interested in their commission, rather than what is in your best interest. If you educate yourself, you can save A LOT of money and probably do just as good a job, if not better.

Invest at least 10% of your gross income

The future is coming whether you want it to our not. The magic of compound interest can make your consistent contributions grow into a large nest egg. Take advantage of tax sheltered retirement account such as a 401(k) and/or Roth IRA. If your employer offers a 401(k) with a company match, take advantage of the free money.

March 2007 Income Statement

We had a great net worth increase in March, but did a poor job staying within our budget. We were sadly over budget $775.68 in March (click on spreadsheet below).

A lot of non-monthly bills hit in March, such as both cars needing servicing, buying a baby shower gift, enrolling wife in new insurance program, and a mini vacation. That’s not a good excuse though because we also went over budget for some of our standard monthly bills.

Time to take back some ground by coming in under budget next month!

Stay tuned. . .

Above Average Income, Above Average Expenses

My wife and I make a combined $109,350 per annum (not including her commission pay). Not more than some, but certainly above average. The tough part though is that we have a very high monthly burn rate – spending close to 90% of our net income each month. I’ve included our monthly budget below (click on spreadsheet).

*Note: This budget does not include our investments/savings.

We spend over 2 times more per month than some couples we know. Granted, most of our friends rent instead of own and condo costs make up 40% of our monthly bills. Nevertheless, we need to slow the bleeding so that we can put more money into our investments/savings.

We plan to make the following changes next month:

- Sell Car 1

- Buy a replacement car for ½ the price of Car 1 – $200/month savings

- Switch to a lower cost Internet/cable package – $20/month savings

- Look into combining auto insurance and condo insurance

- Look into lower cost birth control

Further down the road, we will have the credit cards (0% interest currently) and auto loans paid off. Of course, we also want to sell our condo and get a house in 4-5 years, so that money will be used to help cover the higher housing costs.