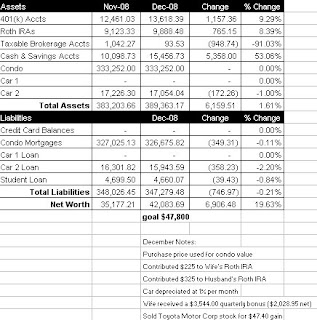

We sold our Toyota Motor Corporation stock (symbol: TM) for a small gain in mid December because we wanted to increase our savings once we got word my wife was to be laid off January 1st. Well this money didn’t stay in our savings account long because we purchased 106 shares Bank of America Corporation stock (symbol: BAC) today of for $14/share.

We’ve been wanting to take advantage of the depressed stock market as much as we’re able to and the financial sector is about as depressed as it gets. We chose to purchase Bank of America stock because we felt it offered the best combination of risk and reward.

Bank of America purchased Merrill Lynch this month, making them the largest financial services company in the world. It seems like they have positioned themselves nicely during this bad economy to come back strong when it rebounds.

For the 4 years prior to 2008, Bank of America stock has been over $40/share, and at times, over $50/share. Taking a look at Bank of America stock price over the last 52-weeks, their high was $45.08/share and their low was $10.01/share. That being said, we believe there is very good upside potential. . .time will tell.

What’s interesting is that we do not bank with Bank of America because they got a little fee crazy and I had to close my account a couple of years ago. The flip side is that all of those fees make for a profitable business. Let’s hope we can share in that profit.