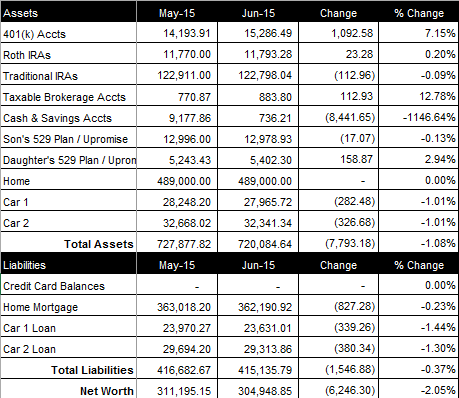

June was a negative net worth month for us but as you will see below, we intentionally depleted our savings. Our net worth decreased $6,246.30 this month, to a total of $304,948.85 (see spreadsheet screenshot).

Retirement Accounts

Our retirement accounts are comprised of my wife’s 401(k), our Roth IRAs and our Traditional IRAs. My wife’s company matches up to 3% of her 401(K) contribution and deposits the sum once a year on January 1st (it is 100% vested when deposited). We contributed $1,083.34 to my wife’s 401(k) this month and saw the total balance of our retirement accounts increased $1,002.90 over last month to $149,877.81.

Brokerage Account

Currently, our brokerage account consists of one stock (my wife’s company) that went up $112.93 this month. Our balance is $883.80 on a $2,000.00 in initial investment.

Cash & Savings Accounts

Cash and savings accounts consists of a small sum of cash at home and our online savings account balance. It does not include our checking account balance that we use to pay our bills each month. This month, our cash and savings accounts decreased $8,441.65, bringing the total to $736.21. Scary low but my wife is having an elective surgery and we received a substantial discount on for paying cash. We are both receiving bonuses totaling $10K-16K in the next 30-60 days which will allow us to refill our savings account.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $0 to our son’s 529 Plan and it decreased $17.07 from last month to a total balance of $12,978.93. We contributed $165 to our daughter’s 529 Plan and it increased $158.87 over last month to a total balance of $5,402.30.

Home

We use the $489K purchase price that we paid in January 2012 for our home value. Current comps in the area are ~$650K. The current balance on our mortgage loan is $362,190.92. We paid an extra $150 towards principal this month.

Cars

“Car 1” is a 2011 SUV with ~60K miles and “Car 2” is a 2012 SUV with ~55K miles. When calculating our net worth, we depreciate the vehicles 1% per month. “Car 1” has a current loan balance of $23,631.01 and Car 2 has a current loan balance of $29,313.86. My wife receives $800/month as a car reimbursement and her gas is paid for by her company. I receive $230.13/month as a fixed car reimbursement and $0.23 per mile as a variable reimbursement (to help cover gas, wear and tear, etc.)

Credit Card Balance

We do not currently have a credit card balance that is not paid in full each month.

One thought on “June 2015 Net Worth Update (-6,246.30)”

Comments are closed.