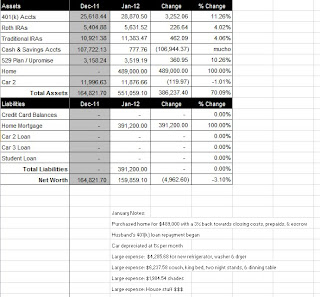

Due to heavy, heavy spending in January, our net worth dropped $4,962.60 from last month, to a total of $159,859.10 (click on spreadsheet below).

What Worked

We have a another asset on our balance sheet – our new home! Moving is always exhausting, but we are finally getting settled in. Beyond the home, we contributed $220 to our son’s 529 Plan thanks to gifts from our parents and aunts. We contributed a total of $1,280.42 our retirement accounts, and saw them increase $3,940.79 to $45,885.49 total. My wife’s company contributed $1,256.63 in company match and profit sharing to her 401(k). I did not include them in the balance sheet because the vesting is 3 years and 6 years, respectively.

What Didn’t Work

Money flew out of our saving faster in January than any time before. Beyond the $97,800 down payment that we put on our new home, we also spent ~$15,000 on furniture and items for the house.

Next Month

It was fun splurging, but now we need to tone it back down. For the next couple of months, our expenses will continue to be higher than normal as we buy things for the house, but January was the BIG spending month.

Congards with finding your new home.

I found new table mush more user friendly, than, lets in December!

You are doing great. Good luck on your way to financial independence!

Why did you buy such an expensive house? Are you planning to have a big family? What interest rate did you get on your mortgage?

Seems like you will need to build up your liquid assets again. Houses are a risky investment in these times.

Financial Independence-

Thank you, we’re enjoying our new home a lot. I’m afaid the table hasn’t changed. Maybe your thinking of the income statement posts, which have a much tougher to read table because of the larger number of figures.

-1MansMoney

Anonymous-

Yes, we do plan to have another child. The mortgage for our 5 bed / 3 bath house with a pool is less than $300 more than what we were paying for our 2 bed / 2 bath rental. Granted, there are other expenses with a home, but to us, it seems like a good value. Our interest rate is 3.75% on a 30 year mortgage. I agree that we need to get our savings built back up and have already started putting money back into savings. Thanks for reading.

-1MansMoney

Your timing was great, historically low 30-year mortgage rates. Hard to beat 3.75%!

Anonymous-

Yes, we feel very blessed to have scored such a great interest rate.

-1MansMoney